The hidden cost of Account Aggregator failures: Why lenders need smart routing solutions

How to solve for the ₹9.6 crore problem of journey drop-offs

Welcome to The Underwritten, where frontline insights illuminate blind spots in digital lending; underassessed operational risks, undertapped market opportunities, and under-tested strategies worth piloting. Curated intelligence for banking and NBFC leaders underwriting their next big decisions.

As of 31st March 2025, 213 crore financial accounts are enabled for Account Aggregator (AA) services. The framework has processed 179.73 million successful consent-based data sharing transactions cumulatively, with a 17% monthly growth rate. Clearly it's India's fastest growing open finance network.

Yet beneath these impressive numbers lies a complex operational reality that every stakeholder, from banks to fintechs to customers, experiences daily.

The Customer Experience Gap

Consider this scenario:

Meet Ahmed. He's exactly the customer every lender wants to serve. Digitally savvy, income-verified, and ready to transact. But when he tried to get a simple ₹50,000 personal loan through a lending app, the journey became a game of interface hopscotch and OTP relays.

First, the lending app redirected him to the Account Aggregator interface. An unfamiliar system with unknown brand names. Then came the OTPs. One for AA registration. Another when he logged into his bank.

When he finally reached the consent screen, it froze while fetching his account details. He tried refreshing. Error message. When he tried his bank login again, a "service temporarily unavailable" appeared. He tried again the next day, but the same interface greeted him with the same problems. More OTPs, more waiting, more confusion.

Ahmed abandoned the process, frustrated by the unnecessary complexity and unreliable systems.

The Infra Debt We're All Carrying

Ahmed's experience illustrates the reality facing 40-50% users today. But these individual failures are just symptoms of deeper systemic issues. A user's success depends on a journey with too many touchpoints, each with a different player. If any single point glitches—whether it's the AA system, the bank's APIs, or a network hiccup—it can bring down the entire process.

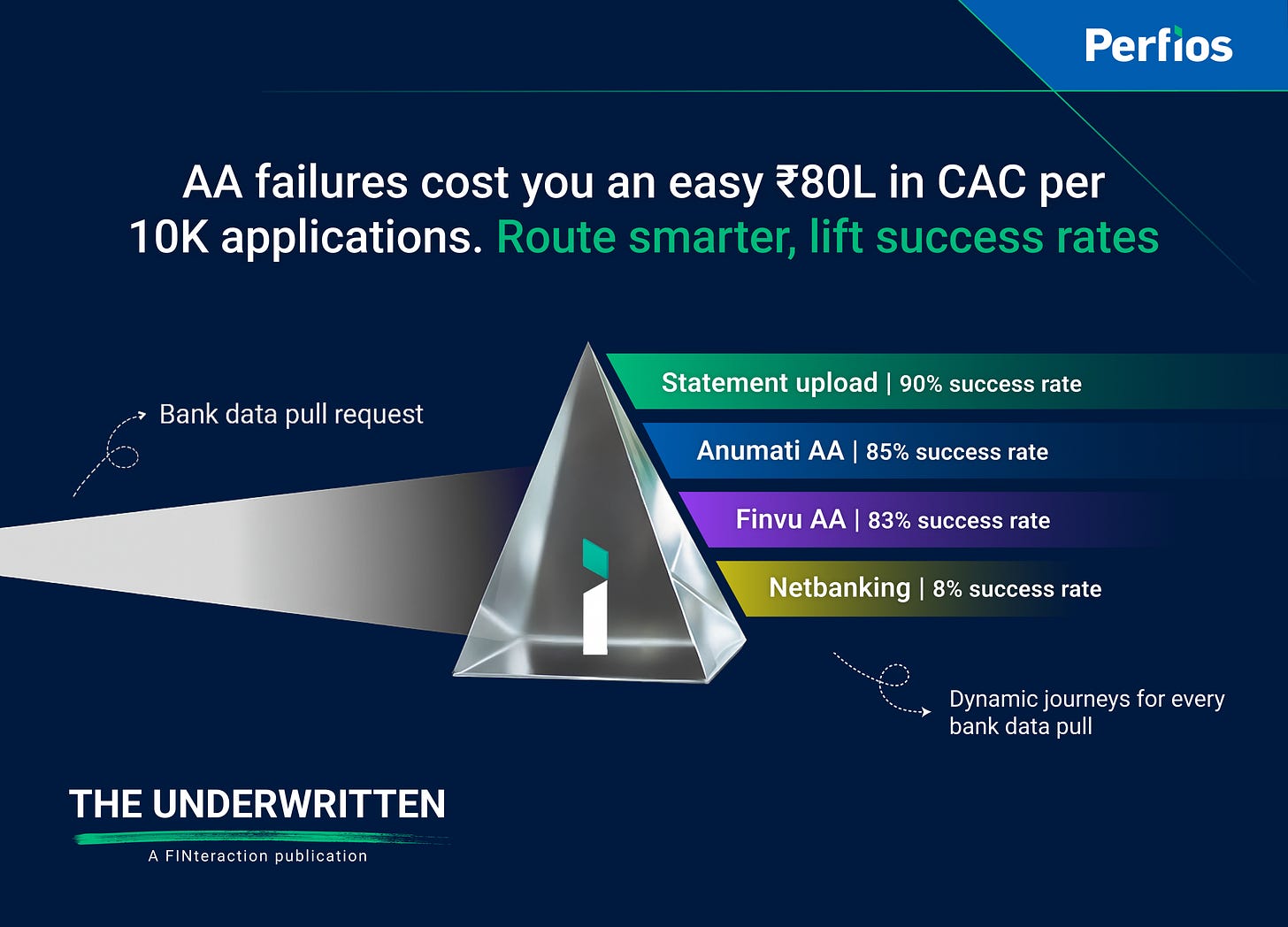

Even with a reasonably good success rate of 60%, those 40% drop-offs carry a steep price. At a conservative customer acquisition cost of ₹2,000 per new-to-bank user, a lender processing 10,000 loan applications monthly is burning ₹80 lakh every month on users who never complete the journey. That's ₹9.6 crores annually, lost to technical failures, user confusion, or frustration.

Multiply this across India's lending ecosystem. Hundreds of lenders, thousands of daily applications; the collective cost of journey drop-offs and AA ecosystem failures would run into thousands of crores. It's not just individual frustration, it's systematic capital destruction at scale.

For an industry built on unit economics and conversion optimisation, these aren't just technical problems. They're business model killers hiding in plain sight.

The Orchestration Answer: Multi-Layered Smart Routing

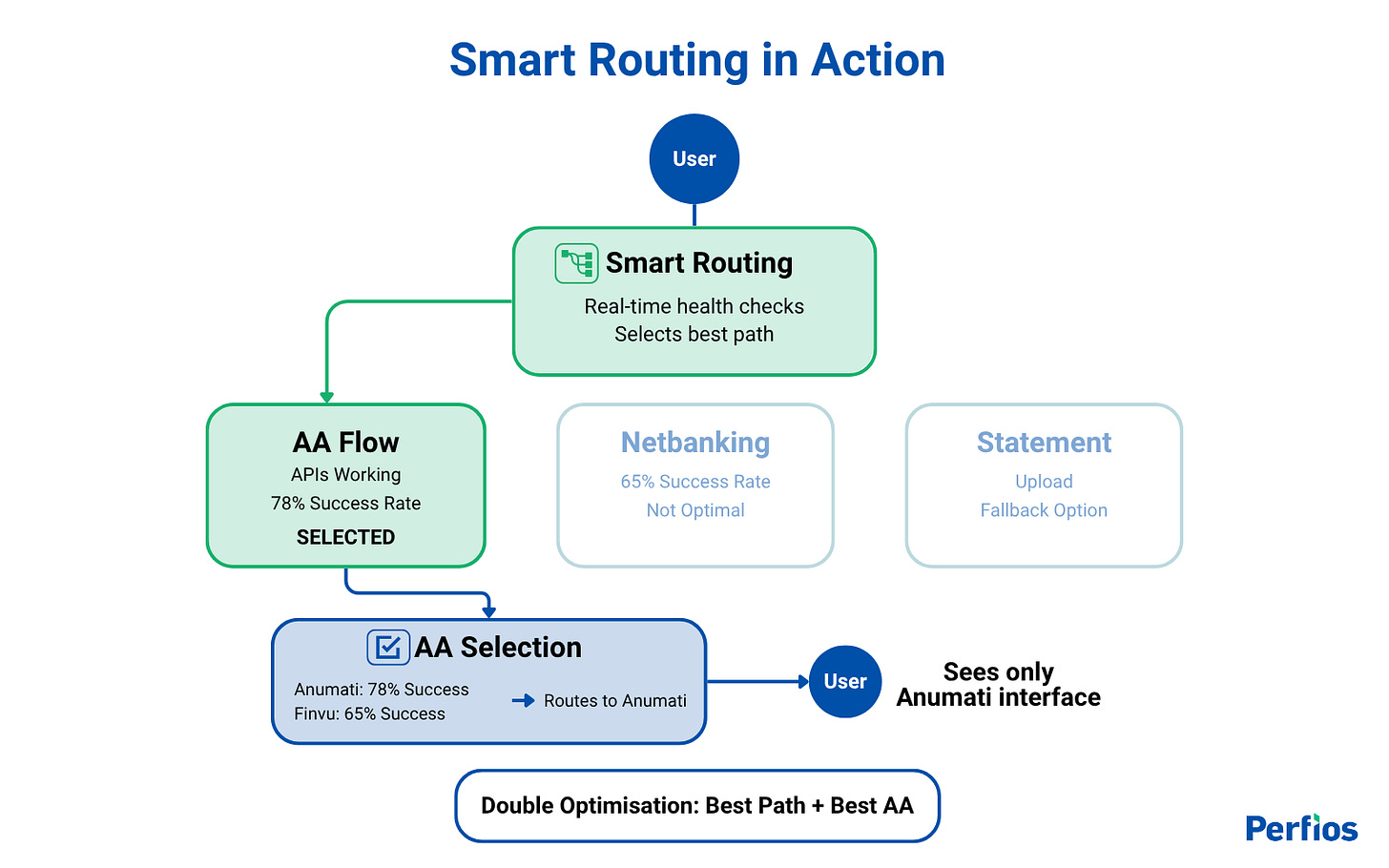

The concept is elegantly simple: instead of forcing users down predetermined paths, analyse real-time data to route them to the option most likely to succeed. This is why we designed Perfios Smart Routing Solution.

Here's how it works:

Layer 1: Intelligent Mode Selection

Before any interface appears to the user, our system leverages Sahamati's SAANS API to perform a real-time health check of the customer's FIP:

Is their bank available and responsive on AA networks?

Should we recommend AA, Netbanking, or Statement Upload for this specific customer?

Which path has the highest probability of success right now?

What routes to suggest in case of a multi-banking scenario?

Layer 2: Optimised AA Selection

If AA is determined to be the optimal path, our system then dynamically selects the most reliable AA for the specific FIP based on:

FIP-AA specific historical success rates enriched with proprietary data

Real-time FIP performance data

Current AA uptime metrics

Layer 3: Strategic Data Fetch Timing

For non-urgent use cases, we strategically decouple consent acquisition (during customer engagement) and data fetch execution (during optimal system availability windows)

Secure broader consents allow multiple fetch attempts without requiring reconsent

This multi-layered approach ensures customers like Ahmed never experience the frustration of failed journeys. They're automatically guided to the path most likely to succeed based on their specific context.

The Competitive Advantage

Our routing intelligence combines ecosystem data with proprietary insights from processing millions of transactions daily and having mapped FIPs' success rates historically. While most rely solely on external data sources that often lag or provide an incomplete picture, we supplement this with near real-time performance patterns that are easily decipherable to us given the scale at which we operate, thereby creating routing decisions based on what's actually working right now, not what worked hours ago.

Additionally, the beauty of such a solution is its universality. Whether the customer is applying through a mobile app, a bank's website, in a branch, or even with agent assistance, the same intelligent routing can apply.

The Business Case: Beyond Incremental Gains

The impact of an easy 15% lift in success rates can be dramatic. Take that same fintech processing 10,000 monthly applications, improving from 60% to 85% success rates means 1,500 fewer drop-offs, saving ₹30 lakh monthly in wasted customer acquisition costs, or ₹3.6 crores annually using our earlier conservative ₹2,000 CAC estimate. This improvement compounds benefits across the entire ecosystem.

AAs, for example, typically charge only for successful data fetches but bear infrastructure costs for all attempts, a common pricing model in financial infrastructure. A 15% improvement in success rates means 1,500 additional billable transactions monthly while serving the same volume for just that one fintech.

The Future of Financial Data Sharing

The Account Aggregator framework represents India's most ambitious attempt to create a unified financial data sharing ecosystem. However, like many complex infrastructure projects, the gap between vision and execution creates real problems for real people.

However, Sahamati is more than proactive in identifying these gaps; its latest router initiative represents a critical step toward solving fundamental interoperability challenges in the AA ecosystem. By establishing a standardised layer for FIU-AA connectivity and FIP discovery, Sahamati is addressing the basic "can connect" question that enables participants to join the network efficiently.

Our smart routing solution complements this foundation by focusing on the "connects well" question. While Sahamati's router enables basic connectivity between ecosystem participants, our solution optimises performance within that connected ecosystem through dynamic routing decisions and strategic timing.

Intelligent routing by Technology Service Providers like ourselves offers a path forward. Not by replacing the existing infrastructure, but by making it work better for everyone through:

Dynamic pathways that adapt to real-time conditions

Context-aware consent parameters that optimise for success

Strategic timing of critical processes

Continuous learning from ecosystem patterns

The future of financial data sharing depends on intelligent orchestration, not just regulatory compliance. With smart routing solutions, we can finally deliver on the promise of frictionless financial data sharing that works for everyone.

Frustrated by high user drop-offs and wasted customer acquisition costs in your AA journey? We've helped leading lenders lift success rates by up to 18% with intelligent data orchestration. Schedule a brief consultation to see how we can solve your AA journey friction.